Consumers and small businesses also get to build a working relationship over time with a bank.

You cannot, however, access the deposit funds till the transaction has accomplished. If Buyer C is downsizing and only buying at £200,000, they won’t need drawdown from casa meaning to lodge any deposit, as it’s coated by the funds already in the chain. As a purchaser, should you can guarantee your funds are despatched over to your solicitor or conveyancer several days in advance of the proposed change date, it ought to assist move things along easily. You can get a pension mortgage when you are retired, but it can be very different from borrowing before retirement. If you’re seeking to take out a mortgage using your pension but have bad credit, there are bad credit mortgages obtainable, depending on your circumstances.

Tips On How To Deal With Drawdowns

Learn more in regards to the distinction between checking and financial savings accounts here. The savings account that’s best for you will depend on your particular scenario. If a mortgage is required, it is probably not potential, as some lenders require a minimal period between change and completion, sometimes five working days.

- An annuity provides certainty in retirement, but lacks the flexibility drawdown can provide.

- Having once fixed the spread , banks are permitted to revise the spread only once in three years except for a major credit event.

- Because it measures only the biggest drawdown, MDD doesn’t point out how long it took an investor to recuperate from the loss, or if the investment even recovered in any respect.

- Another advantage of pension drawdown is that it provides you big flexibility by way of the way you withdraw cash from your pension.

- As noted above, the current account portion of the CASA pays little or no interest.

Stamp Duty Land Tax – paid on your behalf by your solicitor within 30 days of completion. You must pay this amount to your solicitor before you possibly can full in the event that they don’t have enough funds. However, if the seller’s authorized representative has not obtained the funds by 3pm, completion may not happen until the following day – though this is very rare. If a mortgage is involved, the funds have to be sent by the lender to the buyer’s solicitor or conveyancer, who should then move them straight on to the vendor’s authorized firm. The size of time between exchange and completion is no matter all the events concerned comply with, however it’s usually one or two weeks. With pension drawdown you’ll be able to move your money into one or more funds and regulate the quantity and frequency of your withdrawals.

Examples of drawdown

Use our broker kind to get pension recommendation and to discuss the best performing drawdown pension suppliers. Another option is to delay utilizing drawdown from casa meaning your pension, which implies it may keep it up growing, tax free. This might be an possibility should you’ve already received sufficient money to live off. A current account savings account (CASA), offered by some banks, combines the functions of a checking account and a savings account. The customer gets little or no interest on the current account money that is used routinely to pay bills but is paid interest on the savings portion.

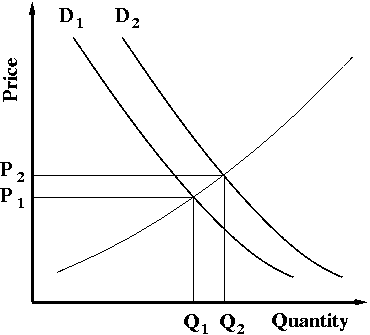

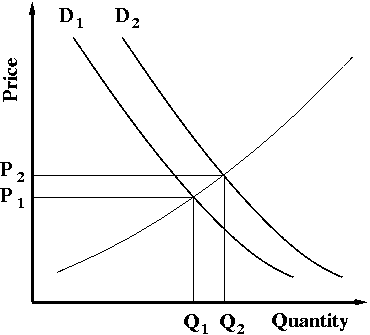

Stock value drawdowns or market drawdowns should not be confused with a retirement drawdown, which refers to how retirees withdraw funds from their pension or retirement accounts. Where drawdown is anxious, remaining funds will be reinvested and for an annuity remaining funds shall be used to buy an annuity product. The Four Percent Rule is a technique for retirees to determine the sum of money they need to withdraw from a retirement account annually.

Current Account Savings Account (CASA): Definition and Formula

With earnings drawdown, should you die before you’re 75, you can also make preparations for it to be handed on to a nominated individual, tax free. A drawdown pension can be a good possibility in terms of inheritance for your family, in contrast with an annuity. The quantity of drawdown from casa tax that may be owed on a drawdown pension has gone down lately. Then, as your pension is taken into account an income, something after that’s taxed as per the income tax construction. There’s at all times danger in investing, and also you might not want this in retirement.

They are a bit less stable for the bank’s lending purposes, and thus earn less interest. In the case of on-demand deposits, a bank can’t be sure how much money it will actually have available to lend. Most banks offer CASAs to their customers for free or for a small fee, depending on minimum or average balance requirements. However, simple human error can sometimes throw a spanner in the works and cause delays. By combining checking and savings functions in one account, the CASA is designed to make it easier for the customer to save week after week.

Provide an umbrella platform through Assisted Financial Services

We embrace pension corporations from our panel that provide income drawdown with their pensions. If you choose to take a large income from your pension fund from the beginning of your retirement, you might run out of cash later in life. A current account does not earn any interest but they don’t have any restrictions on withdrawal or deposits. Savings account does not have any restrictions on deposits but limits the number of times a person can withdraw money.

This works particularly properly if you don’t need a daily income and might subsequently simply dip into your pension here and there as required. Yet while this freedom may beaxy custody sound tempting, there are a number of things to contemplate that will allow you to resolve whetherincome drawdown is a good suggestion for you. As it stands, very few individuals agree that any market has one finest financial institution. Globally, a large share of people consider all banks and monetary institutions are roughly the same. Note that savings accounts are different from checking accounts, which have the most liquidity however usually earn no interest.

What is the average return on a drawdown pension?

This is not possible under external benchmarking regime in respect of loans linked to the same benchmark since any change in the benchmark rate will be reflected in lending rates of all banks on a 1-1 basis. IV.73 In India, literature on the role played by FinTechs in monetary transmission is scanty. Reinvesting the money into a brand new CD allows the curiosity to compound, so that you earn cash on the worth of the unique deposit plus the interest it earned over the maturation period. For an outline of all of your options, and to search beaxy feauters out out the place to get assist and advice, see our guide Options for utilizing your pension pot. Income drawdown is only one of a number of options obtainable to you for taking your pension. You can find FCA registered financial advisers who concentrate on retirement planning in our Retirement adviser listing.

Sabrina Singh, Deputy Pentagon Press Secretary, Holds a Press … – Department of Defense

Sabrina Singh, Deputy Pentagon Press Secretary, Holds a Press ….

Posted: Fri, 04 Nov 2022 07:00:00 GMT [source]

In regions where CASA accounts are common, the percentage of total bank deposits that are in a CASA is an important metric to determine the bank’s liquidity. The CASA ratio indicates how much of a bank’s total deposits are in both current and savings accounts. The deposit that the customer is required to pay on trade is completely different to the ‘deposit’ required by a mortgage lender.